Mar 21, 2025

Why Battery Storage Is the Key to Hitting ESG Targets

ESG isn’t a buzzword. It’s business-critical.

Environmental, Social, and Governance targets are now under the microscope. Investors want transparency. Customers demand sustainability. Regulators expect action.

For companies that don’t deliver, the consequences of a low ESG score can be severe:

Reduced investment

Damaged brand reputation

Regulatory scrutiny

Struggles to attract top talent

So what can be the impact for a company that does not focus on ESG? Risk. Reputational damage. Missed opportunities.

This isn’t about nice-to-haves. It’s about staying competitive.

At VEST, we created our GreenBattery to help companies lead on ESG. Not just talk about it.

Here’s how battery storage can support your company ESG initiatives – and make a measurable impact on your environmental performance.

ESG Targets for Companies: Why They Matter More Than Ever

In the UK, ESG is no longer optional.

The Streamlined Energy and Carbon Reporting (SECR) framework, TCFD alignment, and growing Net Zero legislation mean companies are legally and ethically compelled to take action.

Companies are expected to:

Reduce Scope 1 and Scope 2 emissions

Disclose energy use and efficiency improvements

Demonstrate long-term sustainability strategies

The introduction of mandatory climate-related financial disclosures for large companies has raised the stakes. Transparency is not just preferred, it’s required.

For businesses, this means ESG has to be embedded in operations, not just in reports.

Battery storage is a powerful tool in this transition. It supports energy efficiency, emissions reduction, and sustainable supply chains; all key pillars of an effective ESG strategy.

What Are the Risks of ESG Non-Compliance?

Let’s be clear. ESG failure isn’t just bad PR.

It carries financial, legal, and operational risks:

Investor Withdrawal: Poor ESG metrics lead to divestment.

Regulatory Penalties: As legislation tightens, non-compliance can trigger fines or restrictions.

Customer Loss: Buyers are favouring sustainable suppliers.

Employee Attrition: Talented professionals want to work for purpose-driven businesses.

Poor ESG scores are also now being linked to credit risk. Financial institutions and insurers are assessing climate-related risk as part of their due diligence. If your business scores low, your access to capital could shrink or become more expensive.

Ignoring ESG isn’t just irresponsible – it’s expensive.

Why Batteries Support ESG Targets

Battery storage supports all three pillars of ESG – with measurable impact.

Environmental

Carbon Reduction: Store energy when it’s clean and use it when needed. Slash reliance on fossil fuels.

Optimised Energy Use: Shift loads, reduce peaks, and use electricity smarter.

Enable Renewables: Pair batteries with solar or wind to maximise renewable usage.

Reduced Generator Use: Replace diesel generators with clean, quiet batteries.

Social

Energy Security: Batteries provide uninterruptible backup power. Protect your people and your operations.

Noise & Air Quality: Unlike diesel generators, batteries are silent and emission-free.

Workplace Safety: No fuels. No fumes. No moving parts. A safer environment for your team.

Community Impact: Reduce your environmental footprint and support clean air initiatives.

Governance

Transparent Reporting: Use battery data to report progress on ESG metrics.

Compliance Ready: Aligns with SECR, TCFD, and future Net Zero standards.

Smart Controls: Track energy flows, emissions saved, and performance in real-time.

Auditable Impact: Share clear progress with stakeholders, investors, and auditors.

If you're asking what can be the impact for a company that does not focus on ESG, think about the reverse of all the above. Waste. Pollution. Risk.

Battery storage flips the script.

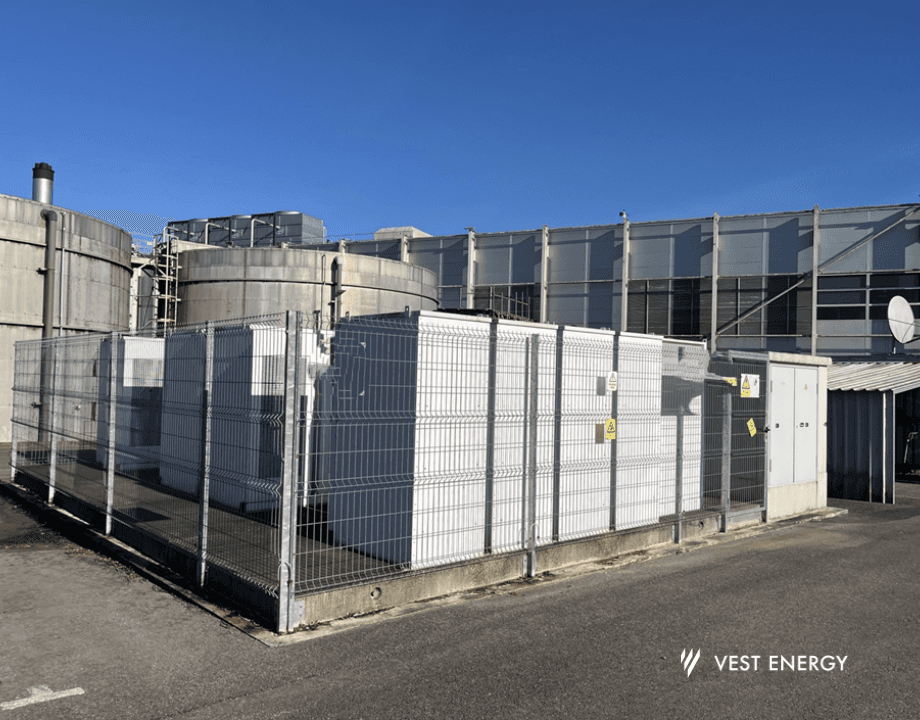

Introducing GreenBattery from VEST Energy

We built GreenBattery to give businesses a better energy future.

It’s more than a battery. It’s a carbon-cutting, cost-saving, ESG-boosting tool.

Our system combines:

Smart battery hardware

Carbon savings intelligence

Real-time energy monitoring

Seamless integration with your site

Whether you're a CFO looking to support company ESG initiatives or a sustainability manager trying to hit targets, our GreenBattery is designed for you.

It provides reliable backup power and helps businesses:

Reduce Scope 1 and Scope 2 emissions

Lower energy bills

Report on progress

Engage with grid services for added revenue

Build ESG performance into core business strategy

We believe energy assets should work harder. GreenBattery does just that.

Real-World Application: Battery Storage in Action

Let’s take a hypothetical example.

A mid-size manufacturing business has high electricity consumption, frequent grid disturbances, and ambitious carbon reduction goals.

They install to:

Stabilise energy use

Capture savings through peak shaving

Replace diesel backup power

Enable more on-site solar

Within 12 months:

Carbon emissions drop by 20%

Energy bills fall by 15%

Scope 2 emissions become fully reportable

Stakeholders are shown transparent, real-time ESG progress

Battery storage doesn’t just support ESG. It proves you’re walking the talk.

The Business Case for Battery Storage

Battery storage is one of the most effective diesel generator alternatives for business. But its ESG value goes much further.

Here’s what makes it a compelling investment:

Immediate Impact: Cut emissions on Day 1.

Scalable: From SME to enterprise, systems grow with you.

Visible Progress: Transparent data helps teams report success.

Multiple ROI Streams: From energy savings to grid revenues.

Resilience: Energy security for critical operations.

Innovation Leadership: Position your business as a forward-thinking, sustainable brand.

With mounting pressure on ESG compliance and investor scrutiny, battery storage is no longer a fringe solution. It’s central to strategic planning.

Ready to Power Up Your ESG Strategy?

ESG isn’t going away. It’s the new standard.

If you’re setting ESG targets for companies, you need tools that deliver results. Our Green Battery is one of the fastest ways to reduce emissions and report meaningful progress.

We can help you:

Audit your current carbon impact

Forecast cost and carbon savings

Design and deploy the right battery storage system

Connect with grid services for added value

Create ESG-aligned reporting for your stakeholders

The risks of ESG non-compliance are too big to ignore. But the opportunity? Even bigger.

Power your ESG journey with GreenBattery. Get a free assessment today.

ESG isn’t a buzzword. It’s business-critical.

Environmental, Social, and Governance targets are now under the microscope. Investors want transparency. Customers demand sustainability. Regulators expect action.

For companies that don’t deliver, the consequences of a low ESG score can be severe:

Reduced investment

Damaged brand reputation

Regulatory scrutiny

Struggles to attract top talent

So what can be the impact for a company that does not focus on ESG? Risk. Reputational damage. Missed opportunities.

This isn’t about nice-to-haves. It’s about staying competitive.

At VEST, we created our GreenBattery to help companies lead on ESG. Not just talk about it.

Here’s how battery storage can support your company ESG initiatives – and make a measurable impact on your environmental performance.

ESG Targets for Companies: Why They Matter More Than Ever

In the UK, ESG is no longer optional.

The Streamlined Energy and Carbon Reporting (SECR) framework, TCFD alignment, and growing Net Zero legislation mean companies are legally and ethically compelled to take action.

Companies are expected to:

Reduce Scope 1 and Scope 2 emissions

Disclose energy use and efficiency improvements

Demonstrate long-term sustainability strategies

The introduction of mandatory climate-related financial disclosures for large companies has raised the stakes. Transparency is not just preferred, it’s required.

For businesses, this means ESG has to be embedded in operations, not just in reports.

Battery storage is a powerful tool in this transition. It supports energy efficiency, emissions reduction, and sustainable supply chains; all key pillars of an effective ESG strategy.

What Are the Risks of ESG Non-Compliance?

Let’s be clear. ESG failure isn’t just bad PR.

It carries financial, legal, and operational risks:

Investor Withdrawal: Poor ESG metrics lead to divestment.

Regulatory Penalties: As legislation tightens, non-compliance can trigger fines or restrictions.

Customer Loss: Buyers are favouring sustainable suppliers.

Employee Attrition: Talented professionals want to work for purpose-driven businesses.

Poor ESG scores are also now being linked to credit risk. Financial institutions and insurers are assessing climate-related risk as part of their due diligence. If your business scores low, your access to capital could shrink or become more expensive.

Ignoring ESG isn’t just irresponsible – it’s expensive.

Why Batteries Support ESG Targets

Battery storage supports all three pillars of ESG – with measurable impact.

Environmental

Carbon Reduction: Store energy when it’s clean and use it when needed. Slash reliance on fossil fuels.

Optimised Energy Use: Shift loads, reduce peaks, and use electricity smarter.

Enable Renewables: Pair batteries with solar or wind to maximise renewable usage.

Reduced Generator Use: Replace diesel generators with clean, quiet batteries.

Social

Energy Security: Batteries provide uninterruptible backup power. Protect your people and your operations.

Noise & Air Quality: Unlike diesel generators, batteries are silent and emission-free.

Workplace Safety: No fuels. No fumes. No moving parts. A safer environment for your team.

Community Impact: Reduce your environmental footprint and support clean air initiatives.

Governance

Transparent Reporting: Use battery data to report progress on ESG metrics.

Compliance Ready: Aligns with SECR, TCFD, and future Net Zero standards.

Smart Controls: Track energy flows, emissions saved, and performance in real-time.

Auditable Impact: Share clear progress with stakeholders, investors, and auditors.

If you're asking what can be the impact for a company that does not focus on ESG, think about the reverse of all the above. Waste. Pollution. Risk.

Battery storage flips the script.

Introducing GreenBattery from VEST Energy

We built GreenBattery to give businesses a better energy future.

It’s more than a battery. It’s a carbon-cutting, cost-saving, ESG-boosting tool.

Our system combines:

Smart battery hardware

Carbon savings intelligence

Real-time energy monitoring

Seamless integration with your site

Whether you're a CFO looking to support company ESG initiatives or a sustainability manager trying to hit targets, our GreenBattery is designed for you.

It provides reliable backup power and helps businesses:

Reduce Scope 1 and Scope 2 emissions

Lower energy bills

Report on progress

Engage with grid services for added revenue

Build ESG performance into core business strategy

We believe energy assets should work harder. GreenBattery does just that.

Real-World Application: Battery Storage in Action

Let’s take a hypothetical example.

A mid-size manufacturing business has high electricity consumption, frequent grid disturbances, and ambitious carbon reduction goals.

They install to:

Stabilise energy use

Capture savings through peak shaving

Replace diesel backup power

Enable more on-site solar

Within 12 months:

Carbon emissions drop by 20%

Energy bills fall by 15%

Scope 2 emissions become fully reportable

Stakeholders are shown transparent, real-time ESG progress

Battery storage doesn’t just support ESG. It proves you’re walking the talk.

The Business Case for Battery Storage

Battery storage is one of the most effective diesel generator alternatives for business. But its ESG value goes much further.

Here’s what makes it a compelling investment:

Immediate Impact: Cut emissions on Day 1.

Scalable: From SME to enterprise, systems grow with you.

Visible Progress: Transparent data helps teams report success.

Multiple ROI Streams: From energy savings to grid revenues.

Resilience: Energy security for critical operations.

Innovation Leadership: Position your business as a forward-thinking, sustainable brand.

With mounting pressure on ESG compliance and investor scrutiny, battery storage is no longer a fringe solution. It’s central to strategic planning.

Ready to Power Up Your ESG Strategy?

ESG isn’t going away. It’s the new standard.

If you’re setting ESG targets for companies, you need tools that deliver results. Our Green Battery is one of the fastest ways to reduce emissions and report meaningful progress.

We can help you:

Audit your current carbon impact

Forecast cost and carbon savings

Design and deploy the right battery storage system

Connect with grid services for added value

Create ESG-aligned reporting for your stakeholders

The risks of ESG non-compliance are too big to ignore. But the opportunity? Even bigger.

Power your ESG journey with GreenBattery. Get a free assessment today.

ESG isn’t a buzzword. It’s business-critical.

Environmental, Social, and Governance targets are now under the microscope. Investors want transparency. Customers demand sustainability. Regulators expect action.

For companies that don’t deliver, the consequences of a low ESG score can be severe:

Reduced investment

Damaged brand reputation

Regulatory scrutiny

Struggles to attract top talent

So what can be the impact for a company that does not focus on ESG? Risk. Reputational damage. Missed opportunities.

This isn’t about nice-to-haves. It’s about staying competitive.

At VEST, we created our GreenBattery to help companies lead on ESG. Not just talk about it.

Here’s how battery storage can support your company ESG initiatives – and make a measurable impact on your environmental performance.

ESG Targets for Companies: Why They Matter More Than Ever

In the UK, ESG is no longer optional.

The Streamlined Energy and Carbon Reporting (SECR) framework, TCFD alignment, and growing Net Zero legislation mean companies are legally and ethically compelled to take action.

Companies are expected to:

Reduce Scope 1 and Scope 2 emissions

Disclose energy use and efficiency improvements

Demonstrate long-term sustainability strategies

The introduction of mandatory climate-related financial disclosures for large companies has raised the stakes. Transparency is not just preferred, it’s required.

For businesses, this means ESG has to be embedded in operations, not just in reports.

Battery storage is a powerful tool in this transition. It supports energy efficiency, emissions reduction, and sustainable supply chains; all key pillars of an effective ESG strategy.

What Are the Risks of ESG Non-Compliance?

Let’s be clear. ESG failure isn’t just bad PR.

It carries financial, legal, and operational risks:

Investor Withdrawal: Poor ESG metrics lead to divestment.

Regulatory Penalties: As legislation tightens, non-compliance can trigger fines or restrictions.

Customer Loss: Buyers are favouring sustainable suppliers.

Employee Attrition: Talented professionals want to work for purpose-driven businesses.

Poor ESG scores are also now being linked to credit risk. Financial institutions and insurers are assessing climate-related risk as part of their due diligence. If your business scores low, your access to capital could shrink or become more expensive.

Ignoring ESG isn’t just irresponsible – it’s expensive.

Why Batteries Support ESG Targets

Battery storage supports all three pillars of ESG – with measurable impact.

Environmental

Carbon Reduction: Store energy when it’s clean and use it when needed. Slash reliance on fossil fuels.

Optimised Energy Use: Shift loads, reduce peaks, and use electricity smarter.

Enable Renewables: Pair batteries with solar or wind to maximise renewable usage.

Reduced Generator Use: Replace diesel generators with clean, quiet batteries.

Social

Energy Security: Batteries provide uninterruptible backup power. Protect your people and your operations.

Noise & Air Quality: Unlike diesel generators, batteries are silent and emission-free.

Workplace Safety: No fuels. No fumes. No moving parts. A safer environment for your team.

Community Impact: Reduce your environmental footprint and support clean air initiatives.

Governance

Transparent Reporting: Use battery data to report progress on ESG metrics.

Compliance Ready: Aligns with SECR, TCFD, and future Net Zero standards.

Smart Controls: Track energy flows, emissions saved, and performance in real-time.

Auditable Impact: Share clear progress with stakeholders, investors, and auditors.

If you're asking what can be the impact for a company that does not focus on ESG, think about the reverse of all the above. Waste. Pollution. Risk.

Battery storage flips the script.

Introducing GreenBattery from VEST Energy

We built GreenBattery to give businesses a better energy future.

It’s more than a battery. It’s a carbon-cutting, cost-saving, ESG-boosting tool.

Our system combines:

Smart battery hardware

Carbon savings intelligence

Real-time energy monitoring

Seamless integration with your site

Whether you're a CFO looking to support company ESG initiatives or a sustainability manager trying to hit targets, our GreenBattery is designed for you.

It provides reliable backup power and helps businesses:

Reduce Scope 1 and Scope 2 emissions

Lower energy bills

Report on progress

Engage with grid services for added revenue

Build ESG performance into core business strategy

We believe energy assets should work harder. GreenBattery does just that.

Real-World Application: Battery Storage in Action

Let’s take a hypothetical example.

A mid-size manufacturing business has high electricity consumption, frequent grid disturbances, and ambitious carbon reduction goals.

They install to:

Stabilise energy use

Capture savings through peak shaving

Replace diesel backup power

Enable more on-site solar

Within 12 months:

Carbon emissions drop by 20%

Energy bills fall by 15%

Scope 2 emissions become fully reportable

Stakeholders are shown transparent, real-time ESG progress

Battery storage doesn’t just support ESG. It proves you’re walking the talk.

The Business Case for Battery Storage

Battery storage is one of the most effective diesel generator alternatives for business. But its ESG value goes much further.

Here’s what makes it a compelling investment:

Immediate Impact: Cut emissions on Day 1.

Scalable: From SME to enterprise, systems grow with you.

Visible Progress: Transparent data helps teams report success.

Multiple ROI Streams: From energy savings to grid revenues.

Resilience: Energy security for critical operations.

Innovation Leadership: Position your business as a forward-thinking, sustainable brand.

With mounting pressure on ESG compliance and investor scrutiny, battery storage is no longer a fringe solution. It’s central to strategic planning.

Ready to Power Up Your ESG Strategy?

ESG isn’t going away. It’s the new standard.

If you’re setting ESG targets for companies, you need tools that deliver results. Our Green Battery is one of the fastest ways to reduce emissions and report meaningful progress.

We can help you:

Audit your current carbon impact

Forecast cost and carbon savings

Design and deploy the right battery storage system

Connect with grid services for added value

Create ESG-aligned reporting for your stakeholders

The risks of ESG non-compliance are too big to ignore. But the opportunity? Even bigger.

Power your ESG journey with GreenBattery. Get a free assessment today.